All SASH hospitals are open 24/7 all holiday season

- About Us

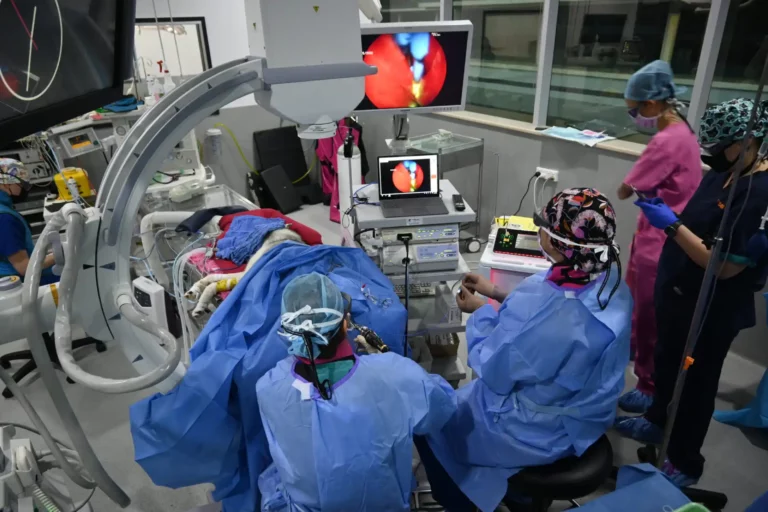

Since first opening our doors in 2007, we have pursued the vision of our founding partners to offer a multi-disciplinary service providing expertise across the spectrum of veterinary specialties.

At SASH, we care for all small animals including avian and exotics and work together with local veterinarians to help pets and their families live their best life.

- SASH Services

Australia’s leading Vet Oncologists providing cancer treatment for dogs, cats and small animals.

Australia's centre of excellence for treating bladder and kidney disease in dogs and cats.

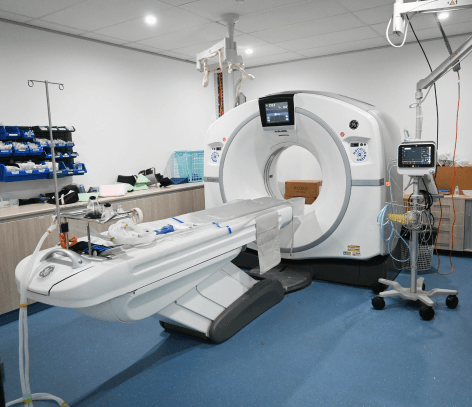

World leading diagnostic testing and treatments for pituitary disorders.

Outstanding 24hr care of all trauma patients, including complex cases requiring advanced treatments and surgery.

Australia’s leading Vet Oncologists providing cancer treatment for dogs, cats and small animals.

World leading diagnostic testing and treatments for pituitary disorders.

Australia's centre of excellence for treating bladder and kidney disease in dogs and cats

- For Owners

The journeys our pets have made and how we've helped them live their best life.

How to safely look after your beloved pet from veterinary professionals.

Our mission to help pet owners shown in the media.

Diseases, Conditions & Treatments

Learn from some of Australia's leading specialists and vets

- For Vets

Make an online referral, upload patient history and more

Order a free copy of our popular Oncology Book.

Order SASH magnets, "about SASH" flyers, after hours posters and more for your clinic

Register for upcoming events or watch previous webinars and videos.

- For Nurses

See all the resources for Nurses in one place.

Look up everything from Acid Reflux to Zika Virus in Pets.

- Contact Us